Case Study – 4 Variants On a 4 Bedroom

We have some new exciting data to share. Recently we purchased a portfolio of mid term rentals which created some momentum in placing tenants who need housing for less than 12 months. These folks are generally victims of fire/flood or guests who need to be in Vegas for less than a year for job reasons. By the way, that herd of “traveling nurses” you keep hearing about doesn’t exist. The bulk of our mid term guests are not nurses. We haven’t come across one nurse yet.

The fundamental reason we have new data is because one of our short term rentals got busted last for not having a license. The owner decided to gamble on a mid term rental since all that furniture was in place. We also have data from a PadSplit we manage. The comparisons are not exact but it’s close enough to gain some insights.

- Short Term – There is no question a short term rental makes serious money. However, you can’t get a license anymore. The license train left the station years ago and the government is slowly stamping out all those unlicensed rentals. Unless you already have a license, there is no reason to keep beating your head against the government wall. ALL short term rentals eventually get busted for not having a license. You may get away with it for a few years but the end is the same.

- Mid Term – We are gaining more momentum here but do not expect to earn significantly more than a long term rental. If you currently have a long term rental, there is no financial justification to buy all that furniture. Furnishing a 4 bedroom house with sturdy furniture (not that Ikea crap), will be in the vicinity of $12k. If you are currently operating an unlicensed short term rental, this is your next phase. You can expect a return of about 5% if you purchase one now that’s already furnished.

- PadSplit – These have to be furnished and the main living areas should be converted to living space. We charge more to manage these because they take a LOT of skill. All it takes is one naughty tenant to sink your property. The ideal property is an older property that doesn’t have an open floor plan. Properties built before 1970 are perfect because they are more chopped up and common areas can be converted to bedrooms. We currently only manage one of these so be advised we are in uncertain waters. You can expect a return of about 5% if you purchase one now that’s already furnished.

- Long Term – We have been managing these for over 20 years so there are no surprises here. If you don’t want any brain damage and need guaranteed income, this is your path to take. You can expect a return of about 4%.

As you can see, purchasing property as in investment in Las Vegas now will create dismal returns. None of the 3 variants available make sufficient income to justify purchasing real estate in a declining market. This case study is used primarily for investors who recently purchased property and are desperate for alternative solutions. There is no good news for them.

SIDE NOTE: I didn’t present any section 8 data because every few years some new customer hands off one of these disasters. The average section 8 rehab costs about $15,000. In the last 30 years, I have never seen a rehab less than $5k. My favorite case is the one tenant who had a warrant for a robbery and did $30k worth of damage. The modest increase in rent the government guarantees doesn’t come close to the amount of damage they cause. I should also mention Mr Taxpayer is paying for all that bad behavior.

Slight Increase In Homes For Sale – Market Flat

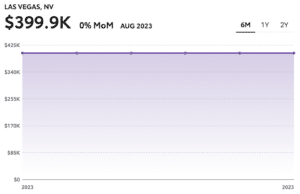

Real Estate Prices Flat

Yawn. Prices are a pinch below last year and the median price of a single family home has not changed much in the last 6 months. There will probably be a slight uptick in median prices in the spring when the primary buyers come out of the winter hibernation. Purchasing anything on the market right now does not make financial sense from an investor’s prospective. We expect prices to drop in 2024 and rents will either remain steady or drop with all the new apartment inventory coming online. Unless you are doing a 1031 you should park your money somewhere else for a few more years.

Slight Decline In Rents – By Bob Kinniburgh

Rents continue to soften after a brief pause in September, rents have declined. According to Zillow ‘ average rents dropped $71 year over year in October. Click here for all the latest statistics.

Renters are still feeling the pinch however. The high cost of housing as well as the continuing impact of inflation is forcing people to make hard choices. See the full video from News 3 here.

It is really difficult to find tenants during the winter. Our current strategy for vacant properties is to slash the price and make the lease expire in the summer. This enables us to get more traffic, fill the unit quickly and have the lease expire when it’s easier to find tenants.

Evictions have seen a small increase in October vs. September but still running well above pre-pandemic levels per Eviction Lab at PrincetonUniversity. Review their finding here.

Existing Customers ->> Software Updates

Some of you may remember the software I built for managing properties. When we first started our business, property management software was ridiculously expensive so I built something to take care of our customers. It was all rubber bands and duct tape! In 2016 we migrated all that data to Appfolio and we shot my sacred cow. Even though some of you complain about Appfolio, it ran circles around my solution. Appfolio runs more accurate reports, automatically updates tenant records, tracks maintenance and much more. The only downside is I can’t tinker with it – which is probably a good thing. I would likely break it…

My favorite feature of Appfolio is that it’s run by teams of software specialists who are constantly making improvements. Appfolio rolled out a new dashboard for owners and features some things you may appreciate. We are also going to start including some other reports that you may find useful.

Appfolio still doesn’t allow you to run your own reports and probably never will. The reason is because most of our competitors conceal revenue generated by maintenance. Unless you don’t already know, we share actual expenses and charge a flat fee for maintenance events. Many of our competitors don’t want property owners finding hidden revenue. In summary, Appfolio isn’t perfect but it’s WAY better than anything out there and certainly better than the jalopy I built.

Existing Customers ->> 3 Months Free Management!

We are looking for customers willing to be interviewed either in person or via a Zoom call. The call will last about 25 minutes and we will ask you a dozen questions on why you like Limestone Investments. If you are interested, hit Jim up at (702) 287-1092 or reply to this email. Our business slows down this time of year and it’s a good time for us to update our marketing materials and work on improving our processes. We sincerely appreciate your business and continue to improve our systems.

Did you know we manage 18 short term and mid term rentals?

You get discounts for staying with us and we would love for you to visit!! Click here to see what we have available.

Get two nights free! When you book any of our exciting stays. Send barb an email ([email protected]) to get your two additional nights. You can transfer this special to friends or family.